For over a century, Moody’s has empowered decision-makers with trusted insights — and today, we’re bringing that legacy to the evolving world of insurance.

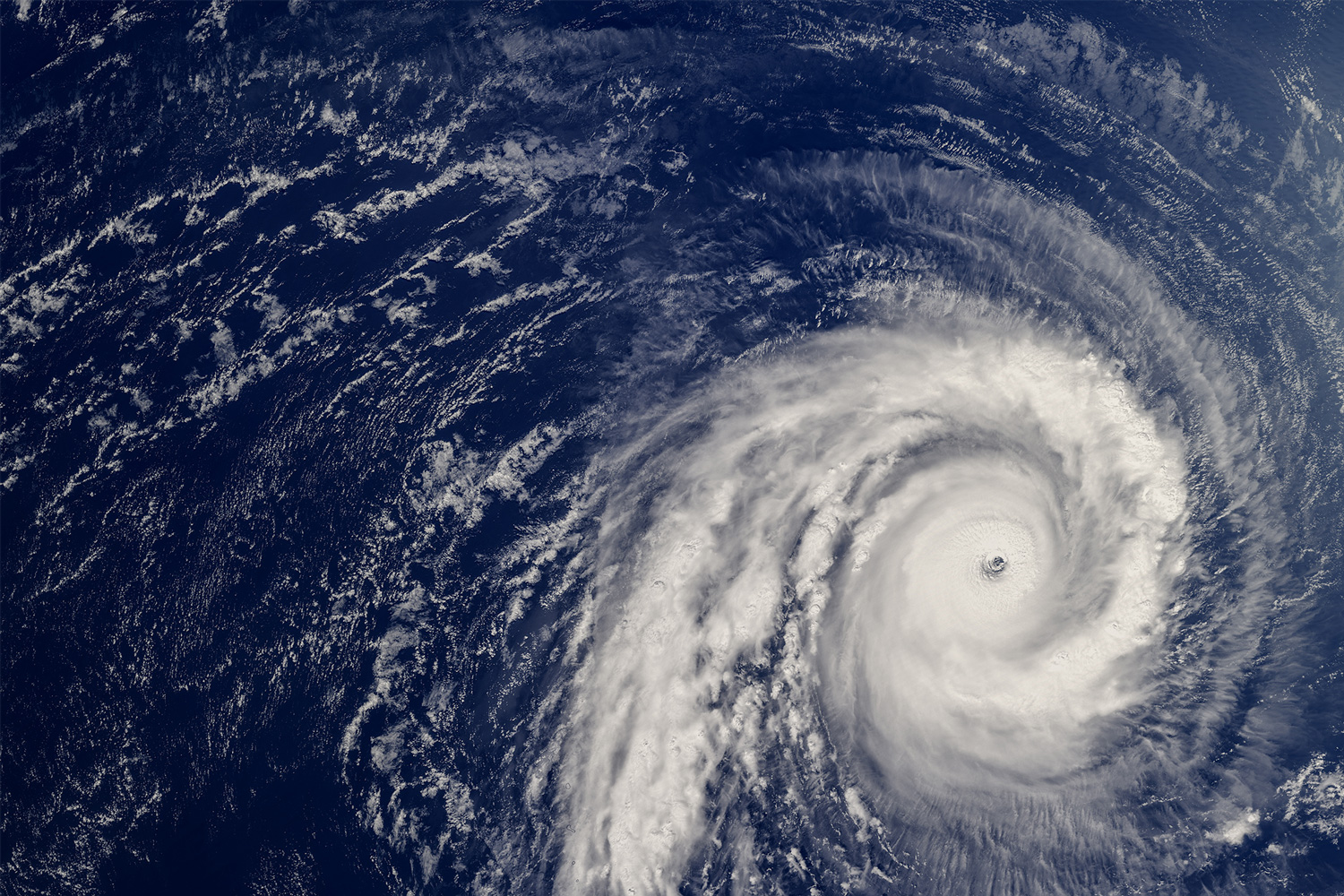

By combining deep risk expertise with advanced analytics, science, and technology, Moody’s delivers a comprehensive suite of solutions designed to help (re)insurers navigate uncertainty, manage complexity, and gain a strategic edge across property, casualty, life, and specialty lines.

From emerging risks to portfolio optimization, our expanding ecosystem supports better decisions at every stage of the insurance value chain.